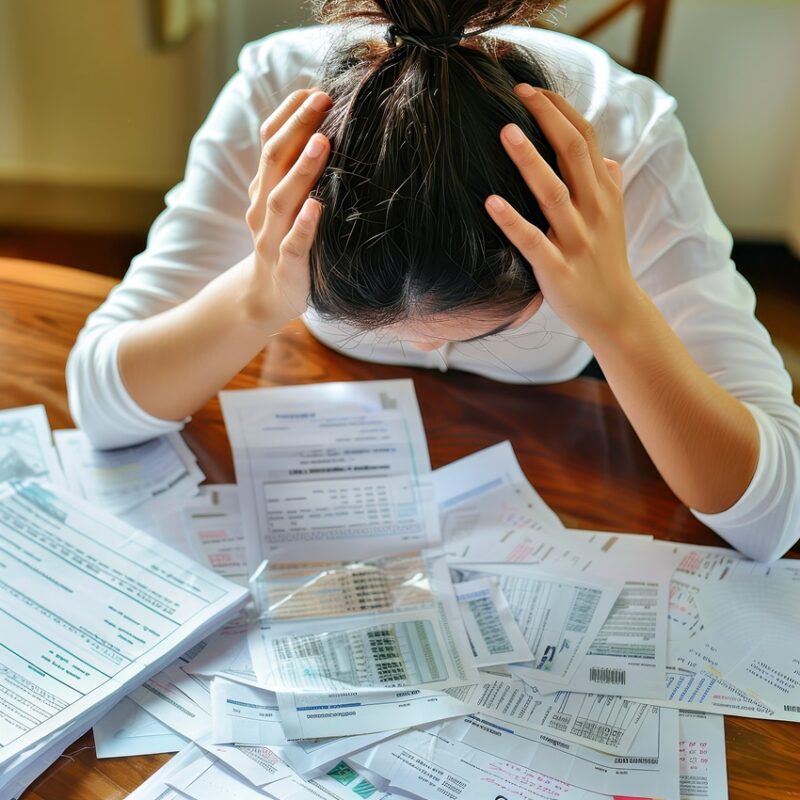

Need a Tax Professional That Knows Your Industry?

We’ve got you covered.

City Tax professionals have knowledge and experience in the unique challenges faced by highly regulated businesses in the Construction, Oil & Gas, Transportation industries and more!

We understand the intricate accounting and tax requirements, processes, and compliance hurdles your business faces.

How can we help?

How can we help?